Through my years as a CFP® Professional, I’ve guided numerous people through the emotional rollercoaster of market cycles. Understanding the psychology behind these cycles isn’t just about managing numbers and trends; it’s more about managing emotions and expectations.

It’s crucial to recognize that markets move in cycles, each with distinct characteristics and psychological impacts. The purpose of this post is to open your eyes to the emotions that may try and derail your long-term financial planning process.

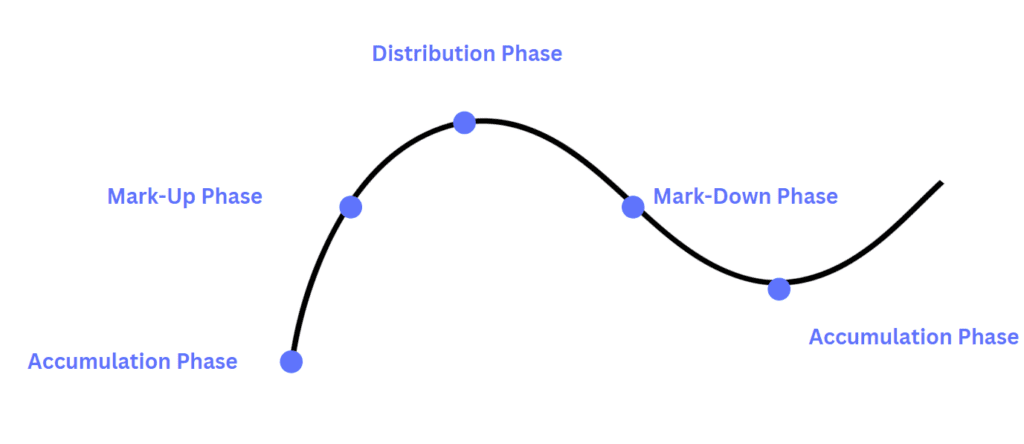

What Are The Four Phases Of A Market Cycle?

One of the most important things I do is help people navigate the ups and downs of investing. Understanding the market cycle is a huge part of that. Before we dive into the emotions that come during the cycle, let’s review the four main phases of a market cycle:

Accumulation Phase: This phase often begins after a market downturn, when prices are at their lowest. Savvy investors start buying, typically at a time when sentiment is still bearish. The risk of loss is lower because prices are depressed, but it requires patience and an ability to see beyond current market pessimism.

Mark-Up Phase: Following the accumulation phase, the market starts gaining momentum. More investors begin to notice the upward trend and jump in, which further drives prices up. During this phase, the market sees a more widespread and sustained increase in high prices. This is often where media attention increases and investing feels more optimistic.

Distribution Phase: This phase is characterized by a plateau in prices. After a significant run-up, some investors start to sell and collect profits. The market can become volatile, with prices fluctuating more. It’s a time when experienced investors might start to reduce their exposure to take advantage of the gains they’ve made.

Mark-Down Phase: Finally, the mark-down phase occurs when the selling momentum increases, leading to a decrease in prices. This can be triggered by various factors like economic changes, geopolitical events, or just the natural cycle of the markets. It often results in a bearish sentiment, and prices can fall back to levels seen in the accumulation phase, or even lower.

Accumulation Phase (Skepticism, Cautionary Optimism)

Imagine this phase as the market’s quiet time after a downturn. It’s where you can find assets at prices that seem like a steal compared to what they’re actually worth. But, understandably, many people feel hesitant to buy in or keep investing because of the recent storm.

Experienced investors and traders, on the other hand, can spot opportunity amidst uncertainty, and start to make their moves. They’re not rushing in, they’re thoughtful and patient. They press forward balancing a healthy dose of caution with a sprinkle of optimism. It’s about recognizing that, despite the lingering gloom, there’s potential for growth over a long enough time horizon.

As we move through the accumulation phase, that initial skepticism many feel begins to gradually shift towards a sense of cautious optimism and belief in the market’s recovery. This change is often subtle and takes some time to unfold. Nevertheless, emotions while investing (or when waiting to enter the market) can be all over the place.

For you, as an investor, navigating this phase is about striking the right balance. Acknowledge the risks, but stay focused on the long-term opportunities this recovery stage presents. Patience is crucial here. Make decisions based on a long-term comprehensive plan, rather than quick, knee-jerk reactions. The accumulation phase is where you lay the groundwork for future growth, and it calls for a careful and measured approach to investing.

Please Note: Believe it or not, this phase can be one of the most dangerous for inexperienced investors. I’ve watched many people make the mistake of hitting the pause button on their investments during the accumulation phase. This hesitation, while completely understandable, can lead to huge opportunity costs. If you’re feeling unsure about your next steps, let’s talk about it. Click the button below to schedule a call with me.

Mark-Up Phase (Excitement, Rush, Euphoria)

Moving on from the accumulation phase, let’s dive into the mark-up phase of the market cycle. After a period of cautious optimism, the market starts to blast off with activity. Suddenly, there’s a palpable sense of excitement and energy in the air. Investors typically begin to feel a rush of exhilaration and anticipation as they watch the market steadily climb to new heights.

During this phase, the market isn’t just hinting at a comeback anymore; it’s making a bold statement. Prices are on the rise, and it’s not just a few isolated spikes. We’re talking about a broad, sustained increase that gets everyone talking. You might start to notice more headlines about the market’s performance and a general sense of financial euphoria brewing. More and more investors are hopping in, eager to be part of the upswing.

You might feel an almost magnetic pull to get more involved, to invest more, as you see others doing the same. It’s infectious, this feeling of being part of a market that’s seemingly on an unstoppable upward trajectory. While it may feel that way, history has shown us that all ups must come down.

Navigating the mark-up phase requires a blend of enjoying the ride while keeping your wits about you. Yes, the market is booming, and yes, it’s exciting to see your investments grow. But it’s also crucial to stay grounded. I can help you channel that excitement into decisions that align with your long-term financial goals.

Distribution Phase (Worry)

Entering the distribution phase of the market cycle, it’s a time often marked by a complex mix of emotions, including worry and an expectation of a rally. Picture this phase as the market taking a breather after an extended growth period. Prices start to plateau, and investors can find themselves in a state of anticipation, wondering if this is just a temporary pause before another upward surge.

In this phase, there’s a clear tension in the air. Many investors find themselves at a pivotal juncture. Some cling to the hope of another rally, while others begin to feel the onset of worry, unsure if the peak has already been reached. This uncertainty can make decision-making challenging, as people feel caught between the optimism of recent gains and the concern of what lies ahead.

During the distribution phase, the market behavior can be unpredictable. Some investors might see the plateau as just a minor setback, holding on to their positions in anticipation of further growth. Others, sensing a shift, might start to take profits and reduce their exposure, leading to more volatility in prices. For you, this could be a time of heightened vigilance, as each market fluctuation can seem like a signal of either continued growth or an impending downturn.

While it’s natural to hope for more growth and to feel anxious about potential declines, your focus should remain on your long-term investment strategy. Temporary emotions cannot be behind the wheel of your long-term financial plan. This is especially true if you feel susceptible to emotions like anxiety. Know yourself, and know you don’t have to navigate worry on your own.

As a financial thinking partner, I can help you consider a variety of “what-if?” scenarios. Together we can steer through uncertainty with a strategy that aligns with your objectives, ensuring that we make decisions based not just on present market conditions, but on a comprehensive view of your investment.

Mark-Down Phase (Denial, Fear, Panic, Helplessness)

As we enter the mark-down phase of the market cycle, it’s a period that can be challenging for investors, often evoking feelings of denial, fear, panic, and helplessness. This phase is characterized by a downward trend in prices, marking a significant shift from the previous growth stages. It’s a time when the optimism of the past phases turns into concern as you watch the value of your investments decrease.

In the mark-down phase, it’s common to experience denial initially. Investors might hope that the downturn is just a temporary blip. However, as the decline continues, fear can set in. This fear can escalate to panic, especially when the market shows no immediate signs of recovery.

The feeling of helplessness can arise as people see their portfolio’s value diminishing despite years of discipline and hard work. Panic selling during this phase often leads to locking in losses. Hasty actions taken from a place of mental scarcity can create massive long-term consequences.

Please Note: The mark-down phase can be particularly challenging without professional guidance. Panic selling can drastically impact long-term retirement plans (often in an irreversible way). However, with the right thinking partner, you can structure your investments to better withstand market downturns and avoid making decisions in a panic. You can also review the key differences between market volatility and risk to help keep your thinking level-headed during this trying phase.

Let Me Help You Master The Psychology Of A Market Cycle

At Snowpine Wealth, I’ve had the privilege of helping clients through the various stages of the market for well over a decade. My process has worked with all four phases of the market cycle—Accumulation, Mark-Up, Distribution, and Mark-Down—and the emotions tied to each. That’s because I’m well aware of the emotions that come into play and how they can affect your retirement.

In stock markets, the Accumulation Phase highlights the value of patience and a forward-looking perspective, balancing caution with optimism. The Mark-Up Phase brings excitement and euphoria, but it’s crucial to stay grounded and aligned with long-term goals. The Distribution Phase introduces a mix of hope and worry, requiring careful consideration of market signals and personal investment strategies. Finally, the Mark-Down Phase can evoke fear and panic, underscoring the importance of avoiding hasty decisions that can cause irreversible damage.

Navigating these cycles successfully demands more than just understanding the market; it requires a partner who can guide you through the emotional highs and lows of investing. So don’t let the complexities of market cycles and the emotions they evoke derail your financial future.

Click the button below to schedule an appointment with me. Together, we can develop and review a comprehensive and resilient financial plan that stands strong through market fluctuations, helping you achieve your long-term financial aspirations with confidence and clarity. And don’t worry, I’ve got a cheat sheet to make it fun and easy to understand!

Securities and advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Advisor. Fixed insurance products and services not offered through Commonwealth Financial Network®.